YTL SGREIT's 2Q13 DPU up 10.2% on strong Singapore performance and contributions from new acquisition

SINGAPORE, 23 July 2013

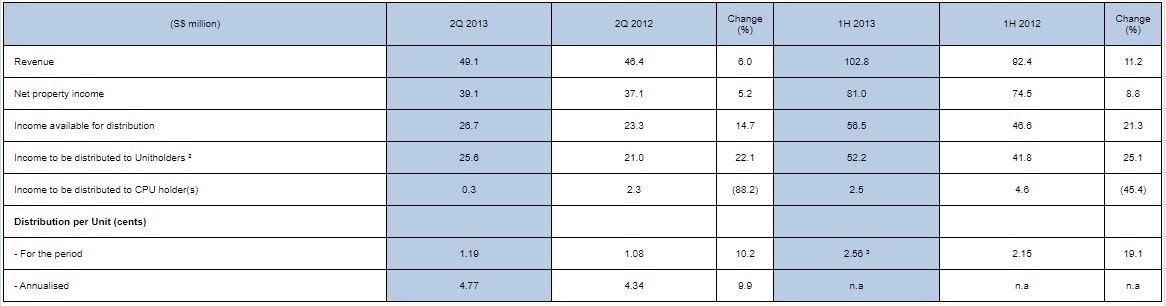

YTL Starhill Global REIT Management Limited, the manager of SGREIT, today announced 2Q 2013 revenue of S$49.1 million, 6.0% increase over that achieved in 2Q 2012. Net property income (“NPI”) for 2Q 2013 was S$39.1 million, representing an increase of 5.2% over 2Q 2012, mainly attributable to the strong contribution from the Singapore portfolio and fullquarter contributions from the recently-acquired Plaza Arcade.

Income to be distributed to Unitholders in 2Q 2013 was S$25.6 million, 22.1% higher than that of S$21.0 million in 2Q 2012. Income to be distributed to CPU holder(s) in 2Q 2013 declined 88.2% y-o-y to S$0.3 million following the CPU conversion into 210.2 million units by the YTL Group on 5 July 2013. Distribution Per Unit (“DPU”) for the period 1 April 2013 to 30 June 2013 was 1.19 cents determined based on the enlarged 2,153.2 million units in issue post-CPU conversion, 10.2% higher compared to the 1.08 cents achieved for the previous corresponding period. On an annualised basis, the latest distribution represents a yield of 5.64% ¹ . Unitholders can expect to receive their 2Q 2013 DPU on 23 August 2013. Book closure date is on 31 July 2013 at 5.00 pm.

Overview of Starhill Global REIT’s financial results

Tan Sri Dato’ Dr Francis Yeoh, Executive Chairman of YTL Starhill Global, said, “SGREIT delivered strong earnings growth in 2Q 2013 largely driven by the strong performance of its Singapore portfolio and contributions from recently-acquired Plaza Arcade in Perth, Australia. While there are concerns that the global economy could soften, we are confident that our portfolio is well-placed to benefit from growing affluence and consumerism in the Asia Pacific region. The YTL Group’s recent increased stake in SGREIT to 36%, following the conversion of convertible preferred units, reaffirms the sponsor’s strong ongoing commitment in the Trust.”

Mr Ho Sing, CEO of YTL Starhill Global, said, ''Our Singapore portfolio has benefited from high occupancy and positive rental reversions from both retail and office in 2Q 2013. We are also pleased that our recent acquisition of Plaza Arcade has proven to be a valuable addition to our portfolio as NPI for the Australia portfolio grew 32.7% y-o-y in 2Q 2013. Looking ahead, the new rental rate from master tenant, Toshin, at Ngee Ann City Retail, continued repositioning of Wisma Atria mall and the 7.2% rental uplift from the Malaysia portfolio master leases with effect from 28 June 2013, will complement SGREIT’s income in 2H 2013.”

Mr Ho added, “We are also pleased to have received a corporate rating upgrade to ‘BBB+’ from ‘BBB’ by Standard & Poor’s. Testament to our prudent capital management efforts, we have already secured refinancing of the debts maturing in September 2013 ahead of maturity. These borrowings have already been substantially hedged, resulting in more than 90% of the Group’s borrowings being fixed or hedged via interest rate swaps and caps post refinancing in September 2013.

Review of portfolio performance

SGREIT’s Singapore portfolio, comprising interests in Wisma Atria and Ngee Ann City on Orchard Road, contributed 63.7% of total revenue, or S$31.3 million in 2Q 2013. The Singapore portfolio’s NPI for 2Q 2013 grew 6.9% y-o-y to S$24.3 million. The improvement was underpinned by high occupancy as prime space on Orchard Road continued to be a springboard for new-to-market retailers, coupled with positive rental reversions for the retail units. Revenue from Ngee Ann City Retail gained 10.1% y-o-y, largely attributable to the 10% rent increase for the period of June 2011 to June 2013 from the completed rent review in 1Q 2013. During the quarter, Toshin’s base rent was increased by 6.7% for the renewal of its master lease over the next 12 years. This was effective from 8 June 2013 and incorporates a rent review every 3 years. In 2Q 2013, Wisma Atria’s retail revenue increased 5.1% y-o-y and its NPI grew 5.2% over 2Q 2012. The increase in NPI was driven by rental contributions from new tenants, following the completion of Wisma Atria’s asset redevelopment in 3Q 2012. Based on leases committed between July 2012 and June 2013, a positive rental reversion of 15.1% was achieved at Wisma Atria Retail. The office portfolio maintained its niche positioning and achieved a positive reversion of 15.6% based on leases committed between July 2012 and June 2013.

SGREIT’s Malaysia portfolio, comprising Starhill Gallery and interest in Lot 10 along Bukit Bintang in Kuala Lumpur, contributed 15.7% of total revenue, or S$7.7 million in 2Q 2013. NPI for 2Q 2013 was S$7.5 million. From 28 June 2013, the portfolio obtained a 7.2% rental uplift from its master leases with Katagreen Development, an indirect subsidiary of the YTL Group, as part of its fixed step-up lease feature, following the start of the second term of the master tenancy agreements.

SGREIT’s Australia portfolio, comprising the David Jones Building and Plaza Arcade in Perth, contributed 10.4% of total revenue, or S$5.1 million, in 2Q 2013. NPI for 2Q 2013 was S$4.1 million, an increase of 32.7% y-o-y, as a result of the full-quarter contributions from Plaza Arcade, offsetting the depreciation of the Australian Dollar against the Singapore Dollar. As at 30 June 2013, occupancy for the Australia portfolio was 99.8%.

Renhe Spring Zongbei in Chengdu, China, contributed 7.4% of total revenue, or S$3.6 million in 2Q 2013. NPI for 2Q 2013 was S$2.4 million, a softening of 1.2% from 2Q 2012. The high-end and luxury retail segments continue to contract, impacted by a continued easing in China’s growth, weaker consumer sentiments and the country’s ongoing austerity drive. While the market is expected to remain active from the expansion of international brands, incoming supply of retail space has placed pressure on the city’s retail landscape. However, Renhe Spring Zongbei remains focused as a highend shopping destination and we continue to fine-tune the tenancy mix to cater to its increasingly discerning VIP customer base.

SGREIT’s Japan portfolio, which comprises six properties located in central Tokyo as at 30 June 2013, contributed to less than 3% of the Group’s total revenue. NPI for 2Q 2013 was S$0.8 million. The decline in NPI was mainly due to the depreciation of the Japanese Yen against the Singapore Dollar, provision for rental arrears and loss of income contribution following the divestment of Roppongi Primo in 1Q 2013.

_____________________

¹ Based on closing unit price of S$0.845 as at 28 June 2013.

² Approximately S$0.9 million of income available for distribution for 2Q 2013 (1H 2013: S$1.8 million) has been retained for working capital requirements.

³ Includes a one-time DPU payout of 0.19 cents to Unitholders on 29 May 2013 due to the receipt of the accumulated rental arrears net of expenses from Toshin master lease in 1Q 2013.

|